Pelham Residents Ravaged by the Great Depression: Record Sale of Tax Liens Advertised in 1932

Order a Copy of "Thomas Pell and the Legend of the Pell Treaty Oak."

Pelham was no different than most communities in the region during the Great Depression that began in late 1929 and continued through the 1930s. Pelham was ravaged by the economic and financial calamity that beset America and the world.

One of the most visible signs of the tragedy of the Great Depression in Pelham was the failure of the Pelham National Bank. Organized in 1921, the bank was a successful little community bank patronized by many Pelham residents. On January 23, 1925, the bank's fortunes changed. Its Board of Directors named a local real estate developer flush with cash from the real estate bubble of the Roaring Twenties, John T. Brook, President of the bank.

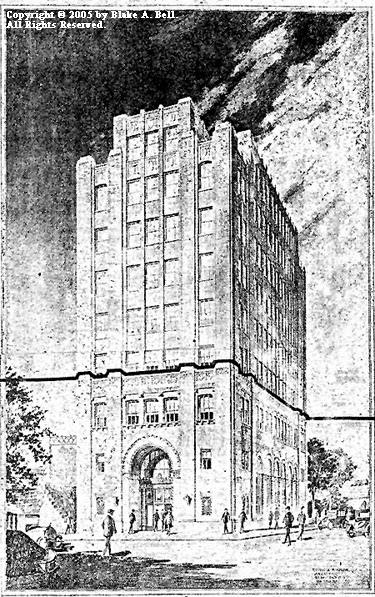

Brook began growing the bank and sold additional shares of stock in the bank. He sold a plot of land he owned to the bank and built the Pelham National Bank Building that still stands at One Wolfs Lane (the former Post Office Building). The building cost the bank an astounding $250,000.00 to build and opened on September 14, 1929, only six weeks before the Black Tuesday stock market crash of October 29, 1929.

The Pelham National Bank closed on the National Bank Holiday decreed by Franklin Delano Roosevelt in March, 1933 and never reopened. It was discovered that Brook had invested bank assets in the stock market and was insolvent. After the bank's failure, Brook was jailed after his Federal conviction for misapplying and misappropriating bank funds and received a five-year sentence. Eventually, banking regulators were only able to return to Pelham residents pennies on the dollar as reimbursement for their lost deposits. Some depositors lost their life savings. To read more about the failure, see:

Bell, Blake A., The Failure of The Pelham National Bank, The Pelham Weekly, Vol. XIII, No. 39, Oct. 1, 2004, p. 12, col. 1.

Wed., Nov. 30, 2005: The Pelham National Bank Building in the Village of Pelham.

Thu., May 05, 2005: John Thomas Brook, Real Estate Developer and Failed Bank President.

Wed., Feb. 19, 2014: Dedication of the Post Office in the Pelham National Bank Building and More About Old Post Offices.

Another visible sign of the economic and financial tragedy suffered in Pelham as a consequence of the Great Depression was the massive increase in delinquent property tax payments and consequent tax liens levied against Pelham properties in 1932. Town officials scrambled to try anything to alleviate the pain and suffering of Town residents resulting from the required sale of tax liens that they knew, in many instances, would lead to subsequent foreclosures. Town Supervisor Joseph H. McCormick unsuccessfully sought State legislation to reduce the penalty for tax delinquencies from 12% to 7%. Another plan to allow installment payments to pay off property taxes turned out to be administratively unworkable. Finally, the Town proposed to postpone tax lien sales for a month to give residents a little more time to come up with the money.

On April 29, 1932, The Pelham Sun published the Notices of Sales of Tax Liens, together with an article about the massive increase in the number of tax liens offered for sale. The list of liens covered much of three pages of the newspaper. The listings included more than 1,300 tax liens for delinquent taxes offered for sale by the Town, the School District, the Village of North Pelham, and the Village of Pelham Manor. The liens covered many residences as well as business including the real estate business of Pelham National Bank President John T. Brook.

Today's posting to the Historic Pelham Blog transcribes the text of the article about the record number of tax liens offered for sale. The text is followed by a citation and link to its source, as well as links to each of the three pages of advertised tax liens for sale.

"Record List Of Tax Liens Advertised; Sale May Be Put Over For Thirty Days

-----

May 25 Is Regular Date for Sale of Liens; Supervisor and Mayors of Pelham Manor and North Pelham to Consider Postponement for Benefit of Taxpayers

-----

What is believed to be the record list of tax liens is published this week and advertised for sale by Supervisor Joseph H. McCormick. The liens cover delinquent State, County, Town and School taxes in the three Pelham villages and village taxes in North Pelham and Pelham Manor. For the benefit of many taxpayers who are victims of the financial depression it is planned to postpone the sale from May 25 to June 24. Supervisor McCormick and Mayors Edward B. Harder and Lawrence F. Sherman are considering the thirty day moratorium.

The postponement of the sale is expected to benefit many property owners who are in severe financial straits because of the depression. The extension of time may permit many to prevent mortgage foreclosures and avoid interest burdens which will be imposed when the tax lien is sold. Several proposals for relief of delinquent taxpayers have been made during the last few months. Supervisor McCormick attempted to effect legislation to reduce the penalty for tax delinquencies from 12% to 7%, but was unsuccessful. It has also been proposed that taxes be paid in two installments, but confusion which would result in the halving of the three separate taxes on local property caused this plan to be abandoned.

Although the 1931 delinquents are greater in number this year than previously, Receiver of Taxes Robert A. Cremins reports that many taxpayers have paid their 1932 taxes during the first month of collection. During April no collection fee was imposed. Beginning Monday a penalty of 2% will be added to the tax.

The list of unpaid taxes will be found on pages 3, 4 and 13 of this issue of The Pelham Sun."

Source: Record List Of Tax Liens Advertised; Sale May Be Put Over For Thirty Days, The Pelham Sun, Apr. 29, 1932, Vol. 23, No. 6, p. 1, cols. 1-2. See also id. at p. 3, cols. 1-4; p. 4, cols. 1-6; and p. 13, cols. 1-8.

Order a Copy of "Thomas Pell and the Legend of the Pell Treaty Oak."

Labels: 1932, Great Depression, John T. Brook, Joseph H. McCormick, Pelham National Bank, Pelham National Bank Building, Property Taxes, Tax Liens, taxes

0 Comments:

Post a Comment

<< Home